Resources:

The New Federal Funds Rate and What it Means for Your Small Business

Let\’s cover the Federal Fund Rate basics, how the Fed uses this rate, and how the FFR affects small businesses.

How to Get Business Loans When You Need Them Most

Knowing where others are making mistakes can give you an advantage when it’s time for you to seek financing. First, let’s look at some of the most common problems small business owners face when submitting a loan application.

If Your Business Can’t Pay Its Bills, Try This

When your business is struggling to stay afloat financially, it can spell disaster. Just like saving a sinking ship, the sooner you act, the better your chances of survival will be. Fortunately, there are steps you can take right now to help you get back in the black. First, we’ll go through how to identify where your business might be leaking cash. Then, we’ll get into managing the debt that’s weighing you down. Ready? Get your life vest on and let’s get started.

How Financing Helps Move Your Products

The costs of distribution and how to manage them by working with the right lender.

Building Your Portfolio with Residential Investment Properties

What do you need to know about making a residential property investment that works for you?

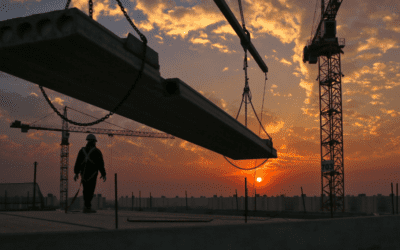

How to Get Commercial Construction Financing for Your Next Project

A vital piece for your project to make it from concept to final inspection is sourcing the right financing. Without that, all of the careful planning and drafting could be a huge waste of time.

What to Know About CRE Loans

If you’re looking for your next (or first) commercial property, you’ve come to the right place. We’ll cover some of the basics of CRE loans, the most common types of CRE loans, and answer a few FAQs along the way.

How to Expand Your Business with Contract Factoring

Here’s one advantage to working with contracts you may not be aware of – factoring. If you’re not familiar with factoring, this article will break down the basics of how you can use factoring to access working capital so you can deliver on larger contracts.

Finding the Right Lender for Your Construction Loan

Let’s take a look at two common types of lenders and how they work differently when it comes to funding your construction project.

How an SBA-Backed 504 Loan Can Refresh Your Business in the New Year

For business owners, the beginning of a new year is an opportunity to evaluate the last twelve months and to look for ways to grow in the quarters to come.